To pass the properties mentioned in your Illinois legal forms to another, the will must first be validated by a court of law through a procedure known as probate. How to make a will in Illinois is a difficult challenge.

You understand how necessary it is to prepare for what will happen to your property, dependents, and remains after you pass away. You can build an Illinois will form that will give you peace of mind and leave your estate in good hands with the right education and planning.

Continue reading to learn how to make Illinois will form and the considerations you'll need to make.

How to Make a Will in Illinois Conveniently?

Components that are mentioned in the template for a will in Illinois are precise. You must, in general:

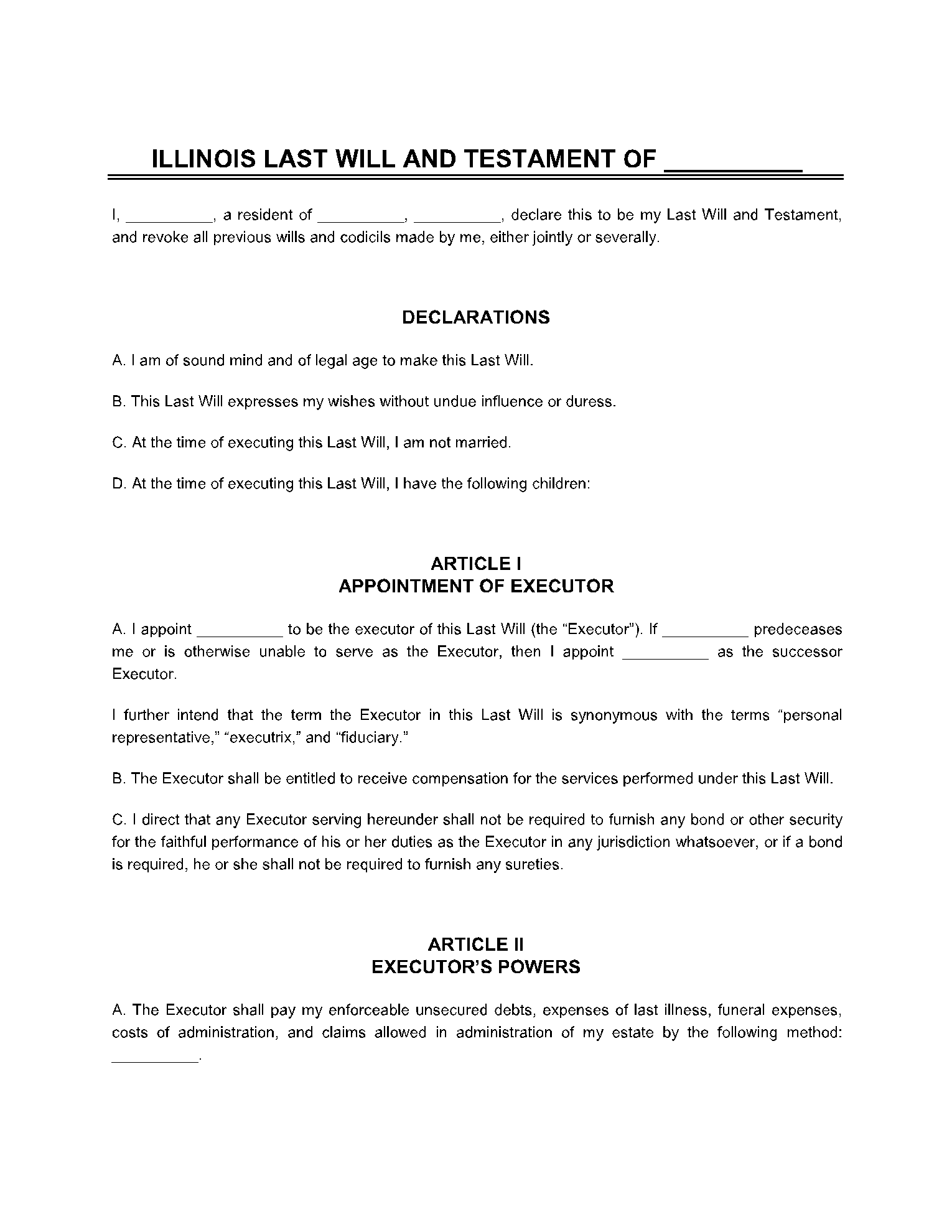

1. Create an introductory paragraph.

Declare your full name and that you are of sound mind and memory in the first sentence of your will. You'll also state that this is your "last Will and Testament" and that all prior Wills and Codicils are revoked.

2. Choose an Executor

Select an executor after establishing your identity and make it clear that this document is a Illinois last will and testament. Your executor must be someone you can rely on.

3. Determine Who Will Be Your Heirs and Beneficiaries

The persons who will inherit your probate estate are known as heirs. Your heirs are your blood relatives who are entitled to a share of your estate under state intestacy rules. In Illinois, the spouse is automatically an intestate successor.

4. Make a Guardian Appointed for Your Minor Children

You can appoint a guardian in your free printable Illinois last will and testament form to look after your minor or dependent children in Illinois. If you die, your children's guardians will determine where they live, where they go to school, and any choices you make as a parent.

5. Examine and Divide Your Assets

Your will must include a section that assesses and divides your property among your beneficiaries. Depending on the terms of your sample Illinois will, you may be required to list specific categories of assets you possess, such as:

- Investing in real estate

- Accounts in the bank

- Accounts for retirement

- Bonds and Stocks

6. Notarize and sign the document

Once you've finished your template for a will in Illinois, you must sign it in the presence of two adult witnesses who are of sound mind and memory, and it's best to practice to include a self-proving affidavit that is also notarized.

What Does Illinois Will Form Contain?

The following is the details you will need to fill out the Illinois will form:

1. General information about yourself. This information includes your name, address, and the date on which you signed the last will and testament in Illinois. Your Illinois will form should also state that it is your final will and that it supersedes all previous wills.

2. The executor's and beneficiaries' names and their details are asked.

3. Who gets what from your savings and property, including your house, investments, and cash, should be specified in your Illinois will form. It should include all of your possessions, including vehicles, furniture, artwork, and jewelry.

4. If you have children that are financially dependent on you, you can appoint a guardian if both you and your spouse pass away at the same time. Although your designation isn't legally binding, it does inform the court of who you want to look after your children.

5. All signatories must be present to fill out the sign section.

What Are the Requirements for Filing a Will in Illinois?

The following are the basic requirements for a Illinois will form:

- The testator must be 18 years old or older.

- The testator must be of "sound mind and memory," according to the law.

- The will must be signed in the presence of the testator or by someone in the testator's name in the testator's presence.

- An Illinois will form requires the signatures of at least two competent witnesses who are not beneficiaries of the will.

- Illinois will have to be written down.

- If the beneficiary is not a witness to the will, they may be provided property by a testator.

Conclusion

Any modifications to Illinois will form only be applicable if they follow the same protocols as the original will. Furthermore, all changes must be made in the testator's presence or by someone acting on his or her behalf or with his or her permission.